Award-winning PDF software

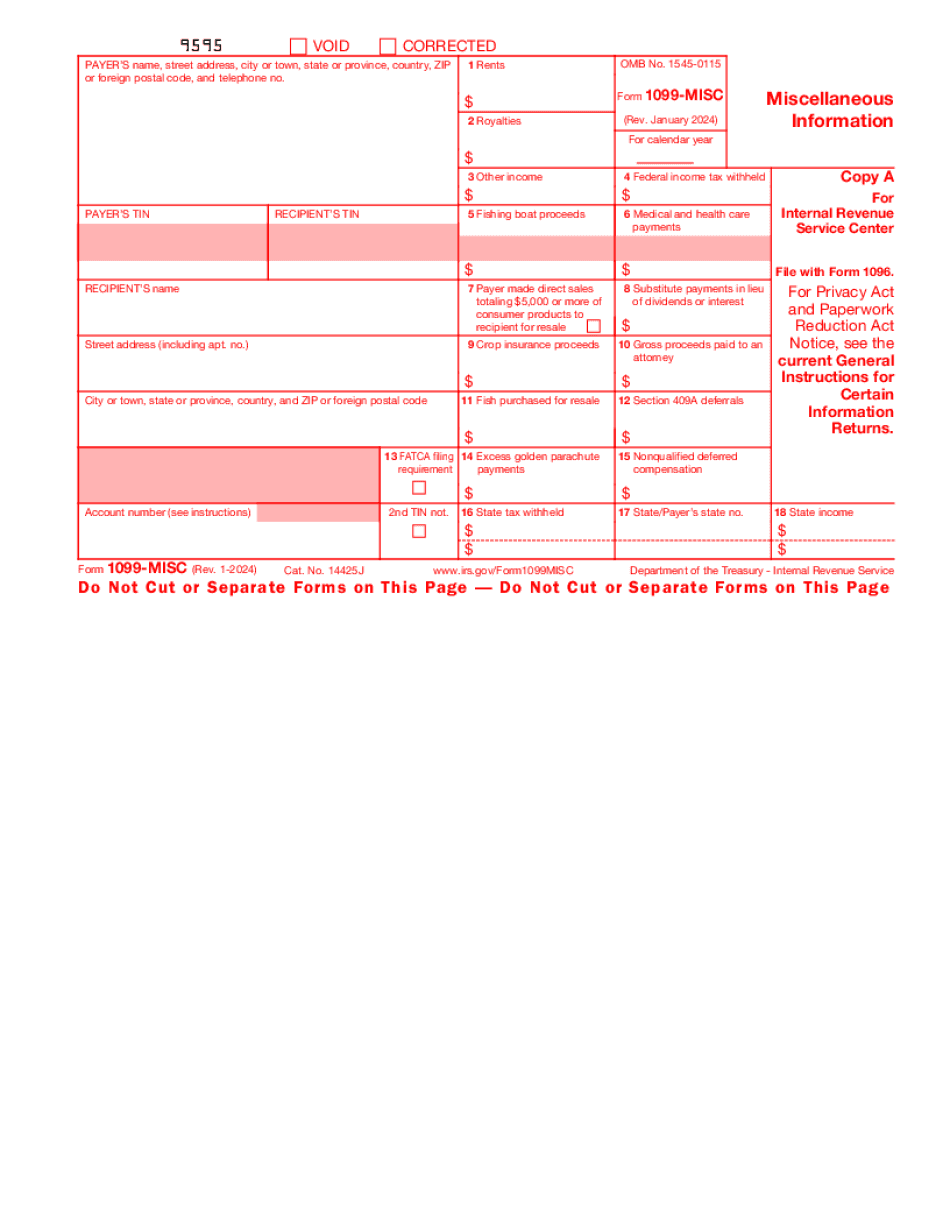

Form 1099-MISC for New Jersey: What You Should Know

State e-Filing Information — Track1099 If a purchase occurred on a 1099, the purchaser and seller must be on the same line. Inspection of 1099 forms — Form 1099-MISC If you have 1099 forms. Check if the tax applies (no state tax paid). There are some 1099 forms which cannot be deducted in state taxes or deducted in state taxes paid. Many 1099 forms cannot be deducted in state taxes or deducted in state taxes paid. If you have any doubts about a 1099 form, contact the Tax Research Division. For example, Form 983 would be non-deductible on state personal income tax and the recipient must be in “Possess” rather than “Seller” status. 10-94 — Information Reporting No state may deduct the amount of sales taxes paid in any year from federal taxes. The New Jersey General Assembly enacts a law providing for the taxation of “rent or lease of a dwelling unit.” It was enacted as a result of a resolution of the General Assembly passed in February 1972. The law provides that the tenant of a dwelling unit shall be liable for rent on the basis of the rental rate at which that unit was occupied on the date of the event giving rise to the liability. This liability shall be in addition to and in lieu of any provisions under the lease agreement which may be necessary to take effect, to be governed under any other applicable statute, rule or regulation, and may include any other requirements of law, including those pertaining to the payment of the minimum rent upon signing the lease. A New Jersey resident who leases property may be liable in the amount specified unless the lease expressly provides for the termination of such obligation as of the end of lease, or in any event as of six months in the event of default in payment of rent. If the contract of lease does not expressly specify a date by which payment will terminate or provide for a minimum amount, the minimum amount is the date of the last lawful rent. The contract of lease does not terminate. The New Jersey Supreme Court has upheld the constitutionality of this statute.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1099-MISC for New Jersey, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1099-MISC for New Jersey?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1099-MISC for New Jersey aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1099-MISC for New Jersey from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.