Form 1099-MISC 2024-2025

Show details

Hide details

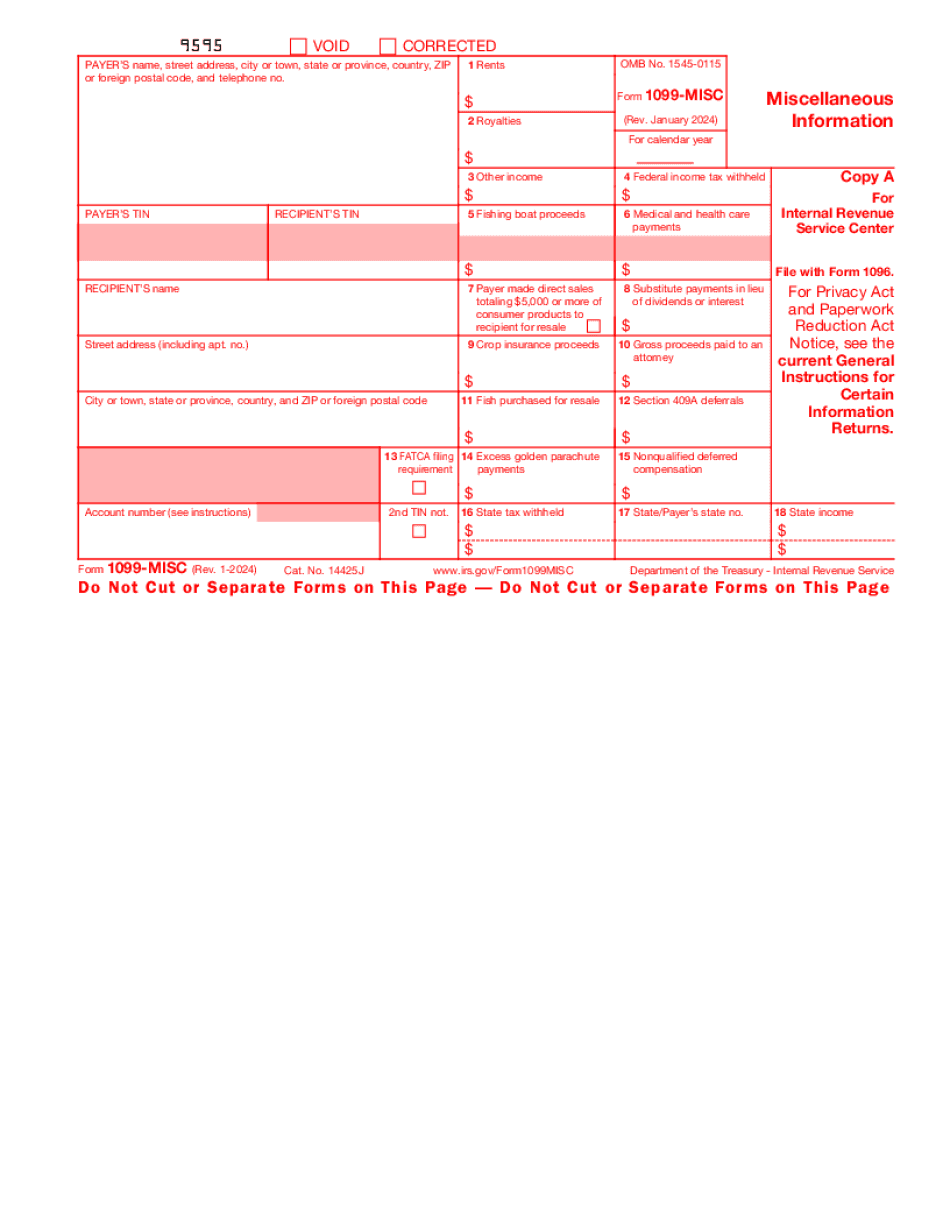

Cluding apt. no. City or town state or province country and ZIP or foreign postal code 9 Payer made direct sales of 10 Crop insurance proceeds 5 000 or more of consumer products to a buyer recipient for resale FATCA filing 2nd TIN not. 13 Excess golden parachute requirement payments Account number see instructions 15a Section 409A deferrals Cat. No. 14425J 16 State tax withheld www.irs.gov/Form1099MISC Copy A For Internal Revenue Service Center File with Form 1096. For Privacy Act and ...

4.5 satisfied · 46 votes

forms-1099.com is not affiliated with IRS

Filling out Form 1099-MISC online

Upload your PDF form

Fill out the form and add your eSignature

Save, send, or download your PDF

A full guide on how to Form 1099-MISC

Every person must declare their finances in a timely manner during tax period, providing information the Internal Revenue Service requires as accurately as possible. If you need to Form 1099-MISC, our reliable and straightforward service is here to help.

Make the following steps to Form 1099-MISC promptly and efficiently:

- 01Import our up-to-date form to the online editor - drag and drop it to the upload pane or use other methods available on our website.

- 02Go through the IRSs official guidelines (if available) for your form fill-out and attentively provide all information required in their appropriate fields.

- 03Complete your document utilizing the Text option and our editors navigation to be confident youve filled in all the blanks.

- 04Mark the boxes in dropdowns with the Check, Cross, or Circle tools from the tool pane above.

- 05Take advantage of the Highlight option to stress specific details and Erase if something is not relevant any longer.

- 06Click the page arrangements button on the left to rotate or remove unnecessary file sheets.

- 07Verify your forms content with the appropriate personal and financial paperwork to ensure youve provided all information correctly.

- 08Click on the Sign tool and create your legally-binding eSignature by adding its image, drawing it, or typing your full name, then place the current date in its field, and click Done.

- 09Click Submit to IRS to electronically send your tax statement from our editor or choose Mail by USPS to request postal document delivery.

Choose the best way to Form 1099-MISC and report on your taxes online. Try it now!

G2 leader among PDF editors

30M+

PDF forms available in the online library

4M

PDFs edited per month

53%

of documents created from templates

36K

tax forms sent over a single tax season

Read what our users are saying

Learn why millions of people choose our service for editing their personal and business documents.

What Is 1099 Form?

The 1099 Misc Form is indented for your use in case you are an independent contractor or a freelancer. It is necessary to report income, other than wages salaries and tips to the IRS. Rental property income, earnings from interest and dividends, sales proceeds and other miscellaneous revenue may be included.

This document may also apply to your situation if you make more than $600 working as a contractor. In case, you work for more than one client, it is obligatory for you to complete a 1099 Misc Form for each client youve performed services for.

It is convenient to submit the paper electronically in PDF format. You may use fillable templates that are available online. Just insert the required information into the fillable fields. Customize and edit according to your needs. Here is the brief guide of how to prepare the 1099 Misc Form correctly.

Follow the instructions below to avoid any possible mistakes.

- 01Insert your personal data: name, address, contact number(s) and ZIP code.

- 02Indicate the social security numbers of both payer and recipient.

- 03Specify rents, royalties or other income. Pay attention to the figures you prto avoid any misunderstanding.

- 04Insert the current date.

- 05Sign the file. You can add your signature by typing, drawing or uploading it.

- 06Forward the document to the addressee.

Note that you must submit the completed document to the IRS by January 31st of the tax-filing year.

Questions & answers

Below is a list of the most common customer questions.

If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the purpose of Form 1099-MISC?

The purpose of Forms 1099-MISC is to make sure that everyone who has earned business income under a given form is properly reporting their gains and losses on their returns.

What does Form 1099-MISC report?

Form 1099-MISC reports certain amounts you receive from the sale, exchange, or rental of the property you own.

How do I report the property I own?

Inspect your tax return to figure out which business income you got from your property. The easiest way to figure your taxes is to add up all your income from that source and then divide by the number of shares you own. Then just divide the total by the total number of the shares you owned and deduct any applicable income tax.

For example, if you receive 10,000 in compensation, and there are eight shares of a stock owned by four different owners, each of those owners receives 50 of compensation, then you get 20 (20 × 8 shares) of income and no income tax, so the IRS treats it as 50 of business income for each owner.

Which forms do I need to report this income?

Form 1099-MISC should be used only when you earn income from your property where you held no other job during the entire year, or when your compensation was 10,000 or less.

Do I have to report all that income on my taxes?

You still have the opportunity to report the income on your tax return. You can use Form 1040.

Who should complete Form 1099-MISC?

The IRS recommends that people with some level of income and assets should complete Form 1099-MISC to report the sale of their primary residence, as well as investments that generate income on which the taxpayer does not have to pay tax (“passive” income), as well as any other income that does not require filing a federal income tax return. These activities typically may be included in a 1099-MISC report, although the IRS does not publish these forms.

Note that a taxpayer who does not sell a primary residence can still elect to report the sale of qualified property if the property is a qualified investment that qualifies under IRC Section 481, or investment income that qualifies under IRC Section 408(d). See Regulations section 1.408A-1(g)(9)-2(g)(9). However, such property is not included in a Form 1099-MISC.

There are three steps to the reporting process. First, a property disposition is noted on Form 1120S (Report of Sale) as well as either Form 1098-T or 1099-MISC, or both. The seller should then wait to file a Form 1099-MISC until the IRS receives the Form 1120S. If the seller did not file a separate IRS Form 1098-T, a Form 1099-MISC is available at any post office, including mail and telephone. The IRS typically reports the taxpayer's basis in the property, or the fair market value, for reporting purposes, within seven days. The seller may also have to file a Form 8283 with the IRS to report certain net proceeds from the sale. A Form 8283 includes the following information:

The names of the parties

The date of transaction

The value of the disposition

The price at which and the amount of net proceeds realized

Determining the fair market value of a property is the key to determining whether the disposition qualifies as a Section 1250 sale under IRC Section 1250A. In any Section 1250 sale, any net proceeds should be included in the taxpayer's tax return. If more than one person participates in the disposition, the person to whom the net proceeds belong is normally included in the gross income from the disposition. This may be due to the fact the net proceeds were used to offset income in another year or were used to reduce the net income subject to taxation in that year (such as for income tax purposes).

When do I need to complete Form 1099-MISC?

The information listed in the following chart applies only to Forms 1099-MISC filed on or before June 30, 2013.

Can I create my own Form 1099-MISC?

Yes. The IRS accepts Form 1099-MISC and 1099-R form for reporting contributions and payments from your own business to your business' employee compensation trust.

How to report a gift to the qualified business trust, or other qualified retirement account:

Use Form 1095-MISC to report the gift to the qualified business trust, or other qualified retirement account;

Attach the Form 1095-MISC to your Form 1040;

Attach Form 1095-R to your income tax return as appropriate; and

See also IRS Publication 519, Charitable Contributions Deduction, for more information.

When should I report these contributions and payments?

To determine how much you should report, you should consider the following factors.

What type of payment or contribution are you making? If there is a contribution or payment from a personal checking account, IRA, or brokerage account, then you should report it on Schedule A. However, if you make deposits or withdrawals from these accounts that do not increase your taxable income, then you cannot claim a charitable contribution deduction. If there is no income from these sources during the fiscal year then you should report the contribution or payment for the year. If you are making a payment for services rendered, you should include the service or fees that result from that payment in the total amount received by the business. You should not include other expenses that may be reimbursed to you for contributions. See IRS Publication 519, Charitable Contributions for more information.

Is the payment or contribution a one-time deal? If you are making a one-time settlement of a tax due, you should exclude the amount from income over the full tax year, including any extensions granted. But to report payments or contributions to retirement accounts from a personal trust that are made over the term of the trust, you must report the payment or contribution over a full tax year.

Example of a one-time settlement of tax due: John and Jane make contributions to a retirement plan for their deceased sister, and John's annual contributions are 25,000. The trust also has 25,000 in assets. The trust pays John 5,000 in a lump-sum payment for the years he served, starting in 2010. John should exclude the amount from income for 2010 including any extensions granted for future years over the full tax year.

What should I do with Form 1099-MISC when it’s complete?

The Form 1099-MISC should be filed at the end of the calendar year following the taxable event that generated the Form 1099-MISC. A 1099 will be issued to the sender of the Form 1099-MISC only if the Form 1099-MISC was filed by a person or business or was received by a person or business. If Form 1099-MISC is filed by mail, the 1099-MISC will not be processed until it is received by a payer of the Form 1099-MISC. The payer could be your employer, a business that you own or control (for example, your spouse), a business trust, a state or local government, or the IRS. Any person or entity that makes or otherwise disburses the Form 1099-MISC will receive a portion of the payment, so an audit may be necessary to determine whether the form was properly completed.

Who should send the Form 1099-MISC to?

Each reportable event or event that occurred on the last day of the preceding calendar year should be entered on the Form 1099-MISC. You should include a statement identifying the business or activity that generated or generated the Form 1099-MISC.

If it does not appear that an event had occurred that would be included on the Form 1099-MISC, such as a casualty, it is appropriate to prepare an attached statement explaining the nature of the event, such as the type of goods used or damage suffered. You should include this information in your attachment to the Form 1099-MISC, in box 10, “Attachment,” and attach this statement to your Form 1099-MISC.

What if my business does not have a taxpayer identification number on file, or it does not have a taxpayer identification number for the reporting period?

A business that has no taxpayer identification number on file, or a private (individual) taxpayer identification number that has expired, can choose not to receive the Form 1099-MISC.

If the business chooses to receive Form 1099-MISC, and it is required by § 601.601-9(d) to prepare the report, the business may prepare an accompanying attachment to show damage, and make a claim for tax reimbursement.

A business that has no taxpayer identification number on file should use another form of reportable event and do not submit the Form 1099-MISC to the IRS.

How do I get my Form 1099-MISC?

You must file Form 1099-MISC if you are either a nonresident alien, nonresident trust, foreign corporation, or foreign individual. You must file Form 1099-MISC if you are a U.S. citizen or resident alien and have income from U.S. sources. See the Instructions for Form 1099-MISC.

If you are a foreign national and the U.S. payer for your services, you can file Form 1099-MISC for any calendar year in which you performed services for that U.S. payer.

If you file Form 1099-MISC electronically for a calendar year, you can include in your income any U.S. source net income from the services. Your U.S. resident employer may deduct a portion of any payment you make to you from the U.S. payer for the services. For more information see the Instructions for Form 1099-MISC.

I have a net profit in a foreign country. Am I required to include my income on my return? What does it mean to me to have a net profit?

You are not required to report any income for a net profit. You and your spouse may receive a Form 1099-MISC if you are married and have the same taxable gross income. If you make a contribution to a Roth-qualified retirement plan with a net income, you will also receive a Form 1099-MISC for the year in which the contribution was received.

I am a nonresident alien. Must I include my net income on my return?

You are required to report your net income received. This includes any foreign source U.S. gross income if any part of it is from U.S. sources, even if that income is received in a foreign country.

In some cases, if you are resident in the United States, this is not the case, in which case the tax is not due. If you live in a foreign country but receive property from a U.S. seller, the sale of the property will often be taxable to you in the country you live in. In these cases, you will have to deduct the sale for U.S. taxes. See Foreign Sales Taxes in chapter 6.

Generally, you will not be required to report net income if you file an income tax return even if you receive capital gain distributions from a foreign financial account.

What documents do I need to attach to my Form 1099-MISC?

You need to attach receipts from each of the following transactions of 600 or more:

Sales of goods

A purchase of services

A delivery, transfer, or disposal of property

A deposit from any source into an account

A debt to a third party (including for taxes, insurance, or similar purposes)

You also need to attach one of the following documents:

Bank account statement

Certificate of deposit (CD) or personal check

W-2 form

W-3 form

You are only allowed to use one of the following receipts:

Form 1099-C

Form 1099-INT

Form 1099-MISC

What if I am unable to submit my required documentation?

Do not mail your documents to the IRS. You should call the toll-free number on the back of your Form 1099-MISC and receive assistance. The IRS can review the document and determine if it is a valid Form 1099-MISC.

If there is another information requirement at the end of your Form 1099-MISC and no acceptable documentation is submitted, your Form 1099-MISC will be declined, and you will receive a notice of non-use.

If you are unable to obtain any acceptable documentation and the IRS requires proof of the correct amount reported, the following may help you:

Certified copy of the sale or purchase of goods

Branch statement or employment agreement for the work performed

Bank statement

Credit card statement

Check stub

Credit card statement or statement of insurance

Other documents

If you cannot submit the information listed above, you may provide Form 1099-MISC in your individual application (see questions below) and ask the IRS for assistance.

If I am a sole proprietorship, can my employer still apply Form 1099-MISC if it requires proof of employment income?

Yes, although the information on your Form 1099-MISC will only be processed if you have also filed a U.S. individual income tax return for the business. The IRS has received inquiries from businesses that have been asking their employees to report the same information on two forms. The IRS does not accept the use of two versions of Form 1099-MISC.

Can a corporation include a member that does not file a U.S.

What are the different types of Form 1099-MISC?

The different types of Forms 1099-MISC include:

Line 11 (1099-MISC line 11) : the form is used for the reporting of noncash fringe benefits and compensation. Payments include:

Contributions to an employee's pension or other retirement plan;

The cost of certain meals, entertainment, sports and entertainment;

The cost of a hotel or motel room, room service, restaurant, travel to a convention, or similar activity. The hotel or motel tax code defines meals and entertainment as “reasonable and customary travel and attendance,” and restaurant, travel and entertainment costs include “dinner, coffee or other refreshments, snacks, drinks, entertainment and incidental expenses, including parking, lodging, parking attendant fee, parking attendant commission, tax, mileage and tolls paid at the time, and applicable state, county and municipal fees, taxes, and tolls”;

the form is used for the reporting of noncash fringe benefits and compensation. Payments include: Payments to employees for retirement or other benefits;

Salary and profit sharing distributions;

Wages paid to an employee, an officer, director, trustee, or similar employee;

Misconduct of employees;

Any other payments, including for a loss, a loss interest, or a return of any investment; and

Dividends and other distributions. The employer is generally required to issue Form 1099-MISC for each payment it issues. There are specific reporting and reporting forms for distributions of the 1099-MISC that are taxable to the employer in the hands of the employee. Generally, the 1099-MISC must be filed annually (generally by May 1) to take effect in the second quarter of the year following the end of the year in which it was received. However, in limited situations an employer may elect to issue Form 1099-MISC quarterly.

the form is used for the reporting of noncash fringe benefits and compensation. Payments include: Line 19 (1099-MISC line 19): the form is used for the reporting of cash reimbursements or other compensation. Payments include:

Pensions, retirement, profit sharing, deferred compensation, etc.;

Contributions to an employee's pension or other retirement plan;

Certain meals, entertainment, sports and entertainment expenses;

The cost of a hotel or motel room, room service, restaurant, travel to a convention, or similar activity.

How many people fill out Form 1099-MISC each year?

Only the filing spouse and the filing dependent shall file IRS-1099-MISC. Only when the dependent has filed a separate tax return on which both the filing spouse and filing dependent have been listed must the filing spouse file Form 1099-MISC.

Form 1099-MISC shall be filled out on or before the tenth anniversary of the date when the taxable year began, and shall not be submitted to IRS. The due date is the last day of the month preceding the tenth anniversary of the taxable year.

If an independent contractor who is not required to file tax returns would file Form 1099-MISC, the taxpayer/independent contractor must file Form 1099-MISC for each applicable taxable year, even if the Independent Contractor is not required to file IRS-1099-MISC.

If your independent contractor has filed a separate tax return on which both the filing spouse and filing dependent have been listed, the filing spouse must file Form 1099-MISC for each taxable year.

Is there a due date for Form 1099-MISC?

See IRS.gov/FilingGuidance.

Do I need to file Form 1099-MISC to make a gift to a charity? Yes. The gift must be made to a charity and made in the same calendar year.

How do I file Form 1099-MISC if I'm making a donation to a religious organization? Do I have to withhold income tax on the donation? The tax exemption for your gift may be canceled. File Form 1099-MISC, Return of Charitable Distribution for a Form 1031 or 1031.pdf, to report the cancellation of the tax exemption.

What should I do if Form 1099-MISC is not received in the timely manner? Contact the institution offering the scholarship, so they can follow up with the recipients. Contact the institution by phone or email to see how your school's Form 1099-MISC was received.

What if I'm not a U.S. resident but made a charitable contribution to a foreign country's charitable organizations? Do I need to report it on Form 1099-MISC? Yes. The institution must report to the IRS the amount of compensation you received from the foreign entity.

Where to File Form 1099-MISC and How to Use It

The form should be completed and filed with Form 1041, U.S. Income Tax Return for U.S. Citizens and Resident Aliens Abroad.

If you're filing for self-employment income, you should file IRS Form 1099-MISC by using Form 1040 EZ or Form 1040.pdf, Employer's Qualifying Statement.

If you're filing as an employer, your Form 1095-EZ or an IRS Form W-2G may be required. Follow these steps in completing Form 1099-MISC:

Download the Form 1099-MISC and pay the 9 fee. Keep the original form within a safe place.

On an original or copy of the form: Fill in blanks. Make sure the form is complete. It may require additional lines. Complete the complete instructions for the Form 1095-EZ. Note: The instructions for the Form 1095-EZ, are only available on the Internet. If your Form 1095-EZ is damaged, get it replaced.

Attach the following statements to your Form 1095-EZ.

Popular Forms

If you believe that this page should be taken down, please follow our DMCA take down process here