Award-winning PDF software

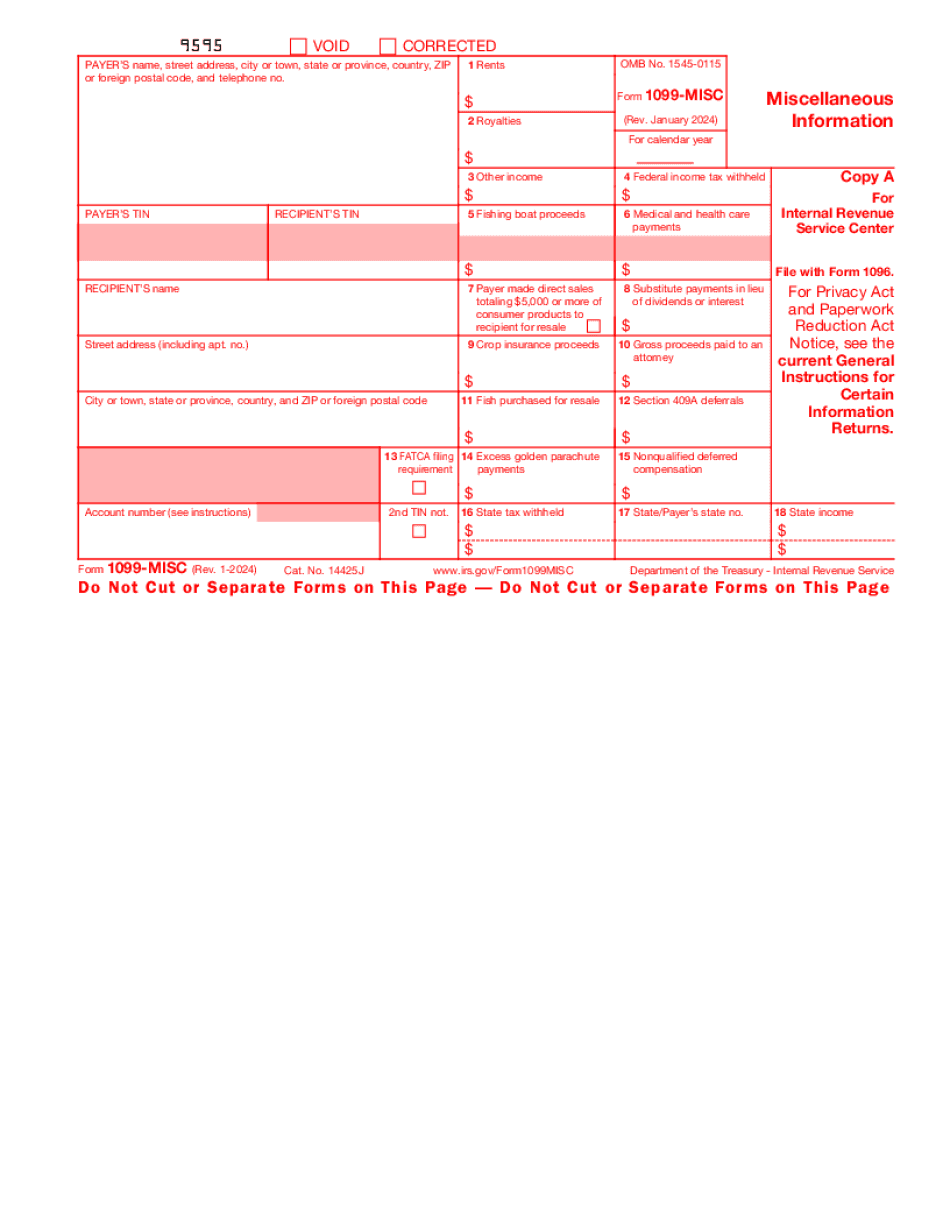

Printable Form 1099-MISC Franklin Ohio: What You Should Know

A “print on demand” PDF file is available for 4.00. This is tax-free but is not the “real” 1099. It also does not include any information you would see on the 1099. This tax-free form should only be used by tax professionals. · Ohio Child Care Tax Credit : OCCUR encourages all Ohioans, with a qualifying child under the age of 18, to receive the Ohio Child Care Tax Credit of 20.00. Qualifying children under the age of 18 can access the Child Care Tax Credit at. The credit is based on the Ohio Child Care Tax Credit for a couple with taxable income of 15,100. If two incomes of 30,000 or more are combined, the combined credit for the couple could be up to 100,000. OCCUR, Inc. was founded to provide information, tools and tax planning related to Ohio's State Child Care Tax Credit in conjunction with state officials and the Office of the Budget Director. For any questions or comments regarding the Ohio Child Care Tax Credit or other OCCUR Services contact: John H. Rump, CPA John Rump, Certified Public Accountant, is the CPA for OCCUR and the author of Ohio Tax Laws. He is the owner of CPA Services Ohio LLC, a business offering services to small businesses. John has over 35 years of experience in the public and private sectors as a certified public accountant. He earned his Master's in Tax Accountancy from Ohio University in 2025 and a Master of Taxation from the University of Toledo School of Law in 2013. He serves as the Chairman of the Ohio State Tax Council. In 2016, he joined the Federal Public Affairs Practice at the law firm of King & Scalding and works as the Principal Tax Professional for the firm. His first book: Ohio Tax Laws, was published by the Ohio State University Press. He currently serves as a freelance writer, writer for various business publications and blogs. He has spoken at seminars on tax topics in Ohio, Pennsylvania, New Hampshire, Florida and New York. Contact information: Email: jruppoccur.net H&E Equipment, Inc.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 1099-MISC Franklin Ohio, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 1099-MISC Franklin Ohio?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 1099-MISC Franklin Ohio aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 1099-MISC Franklin Ohio from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.