Award-winning PDF software

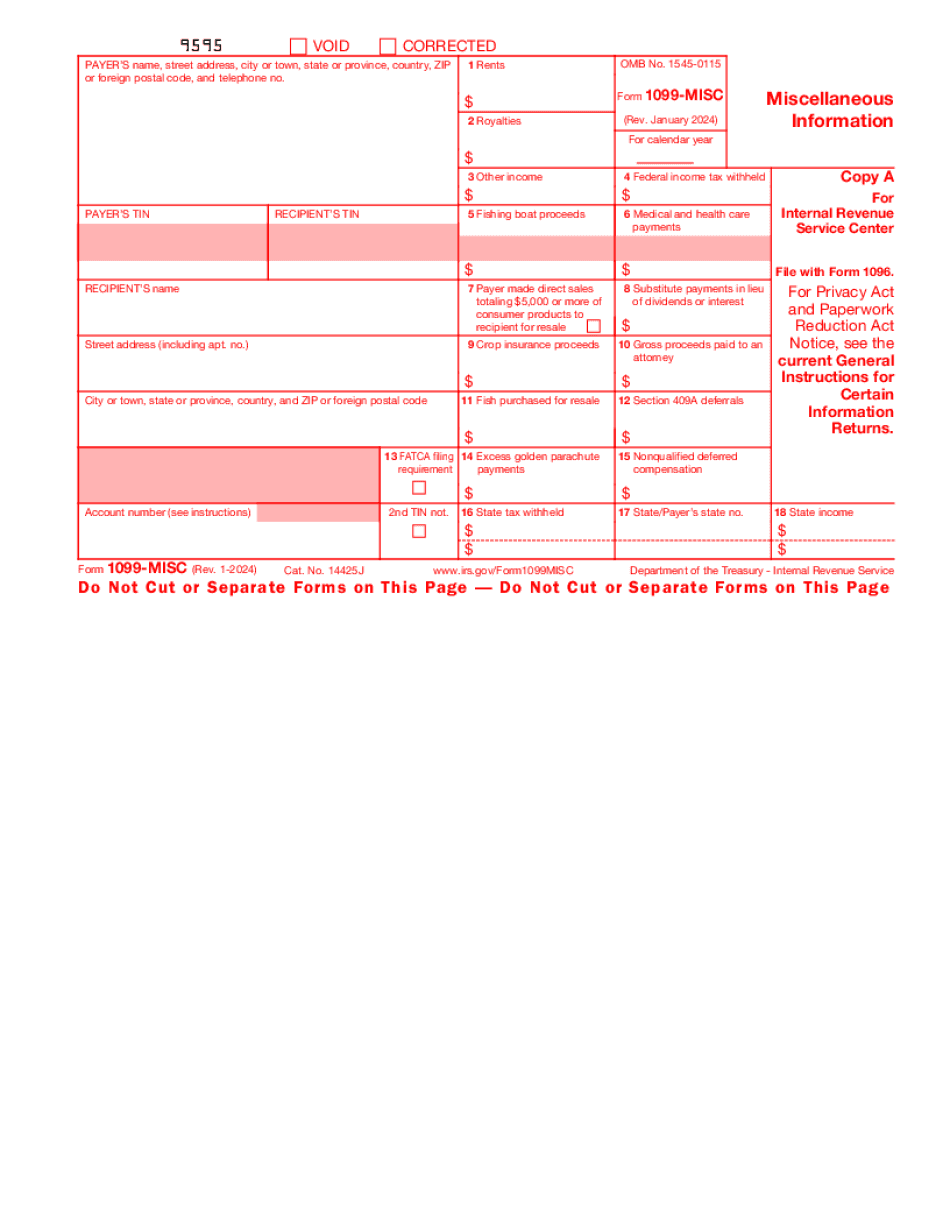

Printable Form 1099-MISC North Charleston South Carolina: What You Should Know

The IRS also requires Molina Healthcare to report any 1099 or B- Notices for employees to get the money. Branch-based Health plans like Molina also report these forms. The forms are available on Molina's website for those who download Form 1099-MISC. You need to print and complete the form and mail it to the IRS. You will receive two copies. Furthermore, you will need to enter “Molina Healthcare” and “Molina” into the search box at the top of the forms if you plan to enter your zip code. Then click “Search” on the top right drop-down list. You might have to click on your country which in my case is United States. The search can take up to 10 minutes so be patient. Please wait for any emails or phone calls to confirm if they received your form. Also, you can download the complete Form 1099-MISC form here The forms, in PDF form, have tabs to add your name and Social Security information. The Form 1099-MISC includes “Molina” in the Social Security number and address fields. In other words, when you file this form with Molina, you will be reporting these payments on a 1099 form, even though it does not report the name on the form. I know because I mailed them. If you have any questions about a form go to Molina's website. Form Pamphlet — Medicare and Medicaid Medicare and Medicaid forms (if you're self-employed) are available for those who can file online. This document (page 3 of the form) should provide all the information you need to fill out your own Medicare/Medicaid application. If you fill that form out online it can't be modified, corrected or reversed. Also, Medicare and Medicaid is considered a business expense, and you can claim any business expenses to get help from the government. For more go to the CDC page from the Centers for Disease Control and Prevention. Form 1095 Summary Report — Form 1095-C You are required to report your self-employment income to have a reasonable basis for claiming and paying taxes that are required by your state of domicile.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 1099-MISC North Charleston South Carolina, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 1099-MISC North Charleston South Carolina?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 1099-MISC North Charleston South Carolina aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 1099-MISC North Charleston South Carolina from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.