Award-winning PDF software

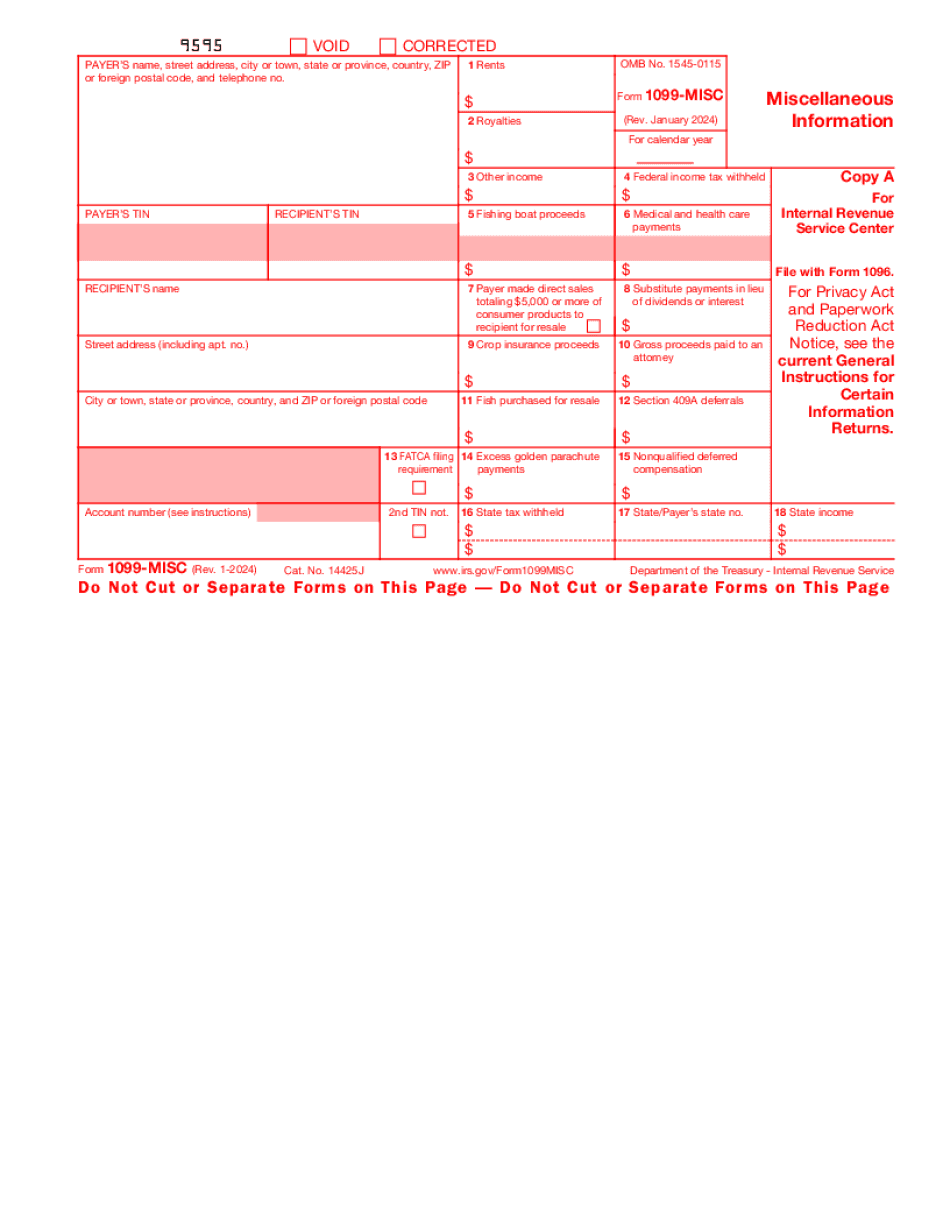

Form 1099-MISC online Oxnard California: What You Should Know

The article also includes information on how to identify these scams and protect yourself against them. Find out your risk factors, the difference between a counterfeit and fraudulent 1099-MISC, and how to recognize an early warning sign when it comes to potential tax fraud. What is Fake Form W-2G, and how do you avoid fraud? — IRS March 24, 2025 — In recent years, taxpayers have received bogus forms designed to make filing faster or easier. This can cost you millions over the long-term, and can result in your taxes being increased significantly. Here's a look at what it is, what to do if you receive one, and what to do if you get caught in the middle. Forms and instructions that show you that filing on paper is still the best option — U.S. Department of the Treasury Jan 1, 2025 — Learn what to do if you receive IRS-approved documents from a company you have a contract with and how to use them to file your taxes and pay your bills. More Forms and instructions are available at the Internal Revenue Service. Tax Tips for Retailers: Use the IRS Free File for small businesses -- IRS.gov Oct 18, 2016— This guide provides basic advice for businesses who use the IRS Free File Program (IRS FREE) for their small business or personal taxes. It shows them how to file and manage their taxes on the Internet using the IRS FREE software, which is free to all taxpayers. It also points out which forms and procedures are mandatory. 1099 Guidance for Filing and Receiving Social Security and Other Government Payments. — U.S. Department of the Treasury — Social Security Administration 2016 Tax Tip 2016-15: Use the IRS free file program. Use Free File in 2025 to file Schedule C. Use Free File to pay other taxes as well as social security and Medicare taxes including FICA taxes, FTA taxes, etc. (Forms 3390 and 4551). For a full-cost quote on Free File for free file, visit Tips for preparing 1099-MISC — IRS.gov March 29, 2025 — If you receive 1099-MISC payments, these can be used for any purpose, as long as the payments were received in the taxable year.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1099-MISC online Oxnard California, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1099-MISC online Oxnard California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1099-MISC online Oxnard California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1099-MISC online Oxnard California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.