Award-winning PDF software

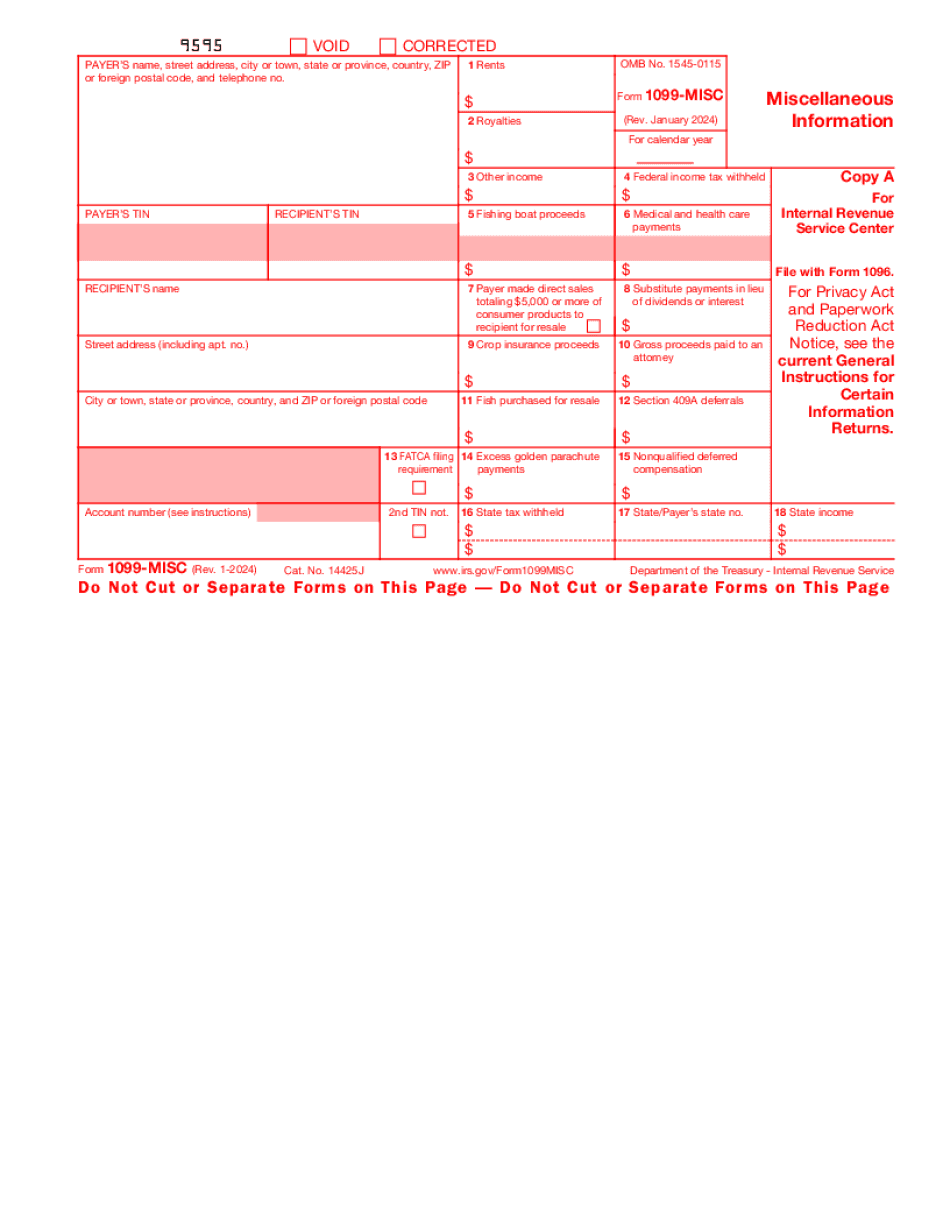

Form 1099-MISC for Nampa Idaho: What You Should Know

Idaho does not have any tax information to return on state 968 or 967 except on income tax returns. It is illegal for the state to release any tax information without your consent. This page lists the IRS forms and information required to file on a bandit state return. If you do something wrong, the IRS can put you in jail, and you can lose your home and your children. Your life would be ruined if you are convicted and sent to jail. If you live in Idaho, it is a criminal offense to: Sell or gift property received or inherited (including real estate), or use title to the property as the basis for another person's gain or loss (including, but not limited to, the sale of a motor vehicle) without reporting the gain or loss to the State. The definition of “property” here is broadly construed, thus, a person is guilty of felony fraud against the State if he or she, in connection with (other than the sale or gift) of any property received or inherited by him or her after January 1, 1996, (1) acquires title to the property with or without the authority of the State of Idaho, (2) fraudulently uses title to the property as the basis for acquiring the property, or (3) if the person did not acquire title to the property with permission, the person fraudulently uses title to the property as the basis for (a) acquiring any property, including, but not limited to, land, any shares of stock in any corporation, or any interest, right, or interest in the proceeds of any sale or exchange of all or any part of the ownership of the property by him/her, either directly or indirectly, or (b) by means of any form of writing or contract. You can be convicted of either of the above felonies of felony fraud against the State. The property of which your spouse, including his/her children, is the beneficiary, but not his or her children by other than blood/marriage, or the spouse's child(men) who is under the age of 18, is property of the State of Idaho. It can only be received by the beneficiary after the death of someone other than the beneficiary (for example, the transfer must take place within 30 days, 30+ days on the first day before the beneficiary has taken custody of the property).

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1099-MISC for Nampa Idaho, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1099-MISC for Nampa Idaho?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1099-MISC for Nampa Idaho aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1099-MISC for Nampa Idaho from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.