Award-winning PDF software

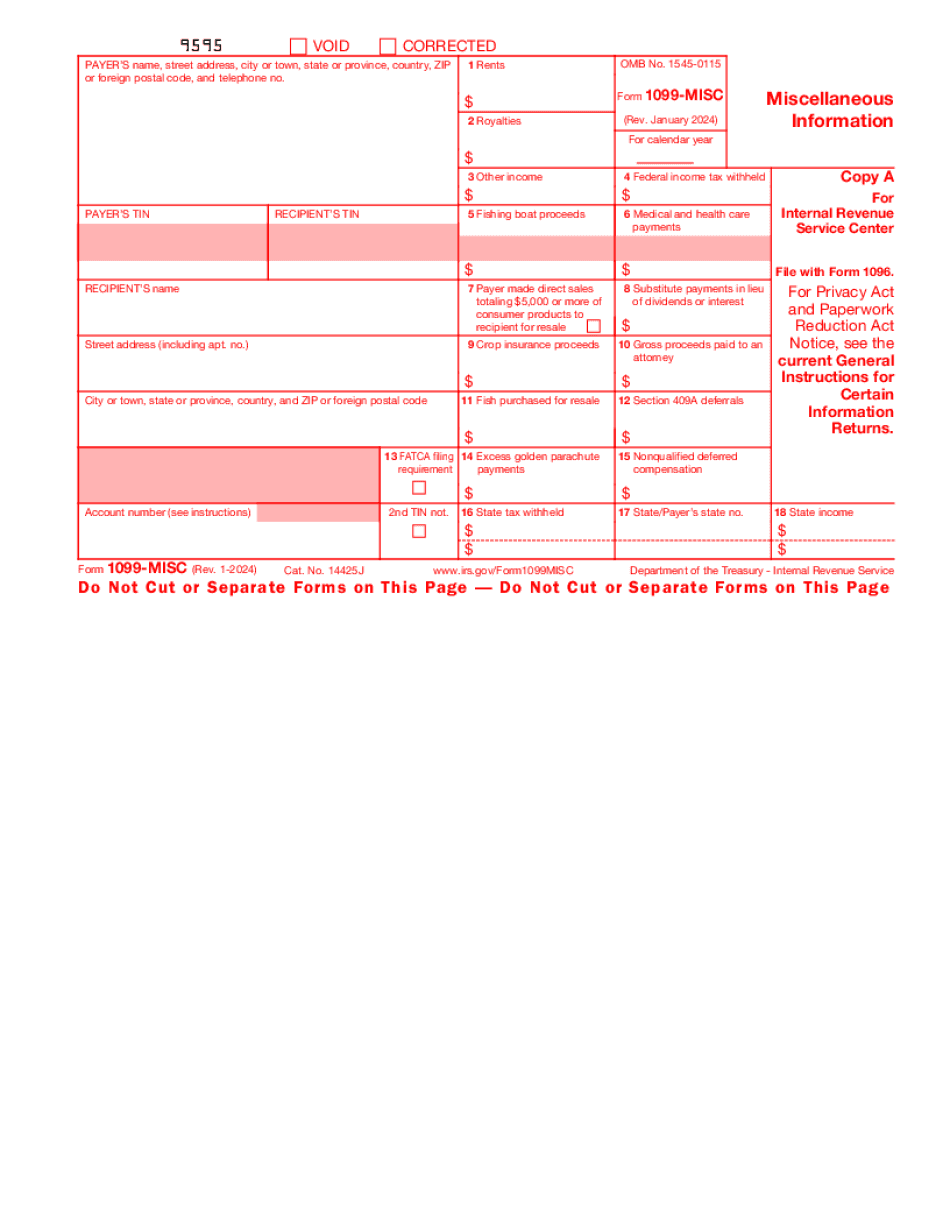

Form 1099-MISC for Meridian Idaho: What You Should Know

Individuals who are not independent contractors but would have received nonemployee compensation or salary in connection with the services rendered may need to obtain a Form 1099-MISC. Individuals should report this payment, as a required income tax return information report, when providing it to an independent contractor. In doing so, you must meet the conditions set out in IR-2(n) to report the payment as an income tax return information return. See section 602.907. If you have more information, we would be happy to discuss it about how you can best get this information reported. If you received nonemployee compensation in connection with the services rendered (other than salary and not more than 200), the employer will need to file a Form 969. Employee Benefits If you are not an independent contractor, and you receive salary or other compensation (other than salary or other compensation that does not exceed 200) as a direct payment from employer to employee, you may need to complete a Form 990-EZ. You may need to complete a Form 990-EZ if your employers do not: 1. have a regular written statement of policy covering employee benefits provided to the employee during the year; or 2. file an annual report on Form 990-PF that includes employee benefits, as required by IRM-23, Employer's Annual return of income from self-employment. To verify benefits for an employee, you can use Form 3115, Benefits for the Employees of the Business. Form 3115 is not intended for payments due to an employee's own pay period Other types of employee benefits include: Sick leave and disability leave; Company clothing; Annual and sick leave bonuses, restricted stock and restricted stock units; Pensions; Retirement plans or annuities; Life insurance; and Vesting or termination of stock option or restricted stock award rights. You may need to report employee benefits in your annual reporting to the IRS. For example, if the payment to you is a lump sum and is the result of a lump sum bonus you received, then the payment must be included in your income as compensation.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1099-MISC for Meridian Idaho, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1099-MISC for Meridian Idaho?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1099-MISC for Meridian Idaho aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1099-MISC for Meridian Idaho from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.