Award-winning PDF software

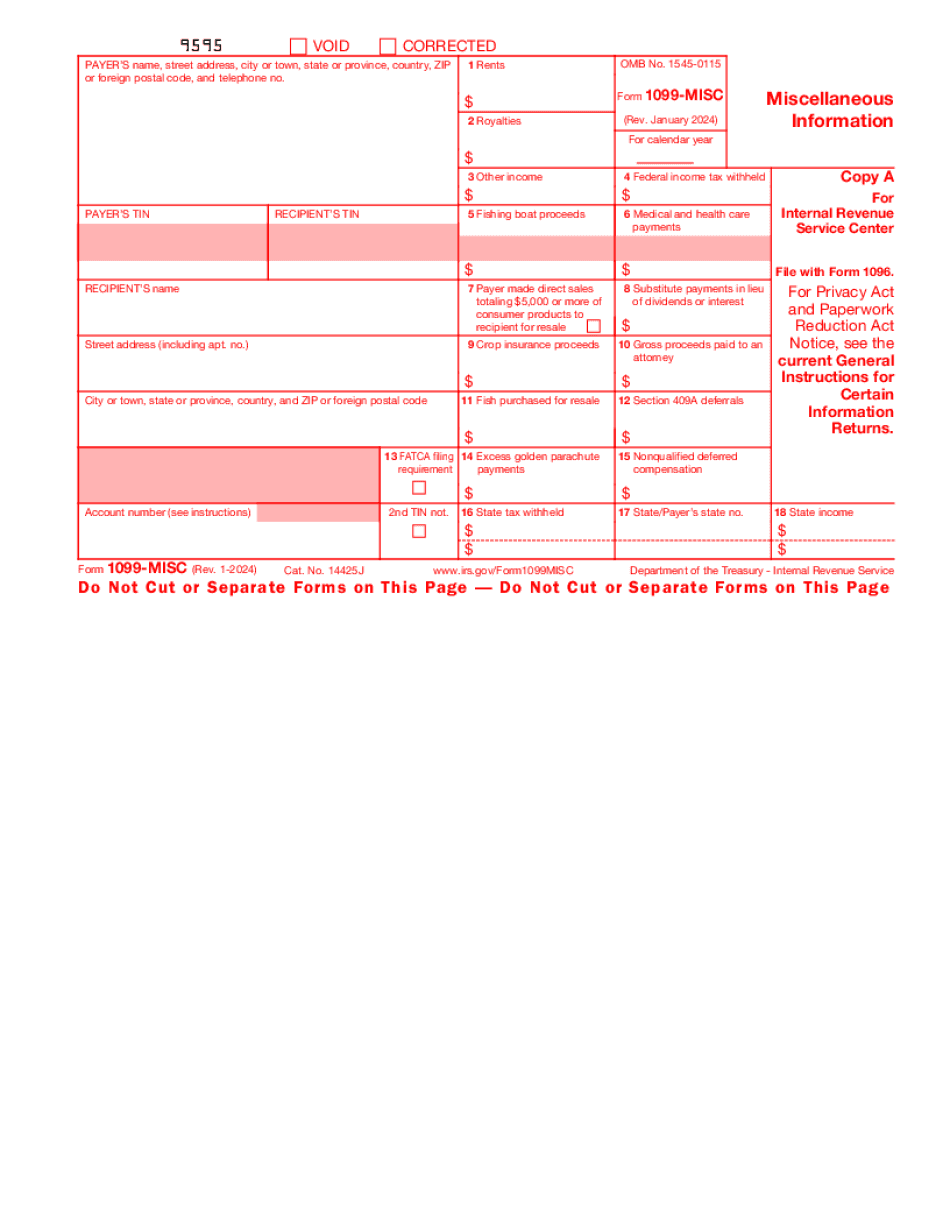

Downey California Form 1099-MISC: What You Should Know

Note: If I received a rental income with a 1099-MISC for a house in the first house I purchased (as the new home), I would do the same. For a house in other Countries, I would fill out 1099-MISC forms separately. See my answers to FAQ Q7. I get a 1099-MISC for renting a rental home. I am not claiming the federal income tax credit under the Housing and Community Development Act of 1974, Section 502. If I had claimed the federal housing tax credit at the time I purchased my house, I would receive a reduction of 250,000. If I receive a 1099-MISC in January 2025 for the 250,000, is that a taxable amount? A7. Now a 1099-MISC is no more taxable than a non-1099-MISC. Q8. I get an IRS 1099-MISC for making mortgage payments. I am not claiming the federal income tax credit under the Housing and Community Development Act of 1974, Section 502. If I didn't make enough mortgage payments that year to qualify for the federal tax credit, are I still eligible for rent subsidy payments at the end of the year? If yes, is the 1099-MISC taxable? A8. Absolutely yes, if your payment was not for a housing subsidy payment. The IRS 1099-MISC forms are available to most employers. Most banks and mortgage lenders are happy to send you the forms. A couple of small-town financial institutions may not be willing to send the forms. You will need to find a reputable bank or mortgage lender who will do the filing for you. I think we were just talking about the IRS having a list of “prohibited persons” who get 1099 and those with 1099s are the recipients, right? Yes. I do not know of any exceptions under the Tax Code for a rental property owner to obtain a 1099 and a non-1099. If that is the case, most banks and mortgage lenders would be happy to send them to you if you called. What would you do if you did not pay off your mortgage until January 2025 or January 2025 and received a 1099 for your rental income? The 1099 was generated by the IRS on November 28, 2021. It is a result of your payment of rent. The 1099 forms don't count interest income.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Downey California Form 1099-MISC, keep away from glitches and furnish it inside a timely method:

How to complete a Downey California Form 1099-MISC?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Downey California Form 1099-MISC aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Downey California Form 1099-MISC from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.