What is the difference between a W2 employee and a 1099 contractor?

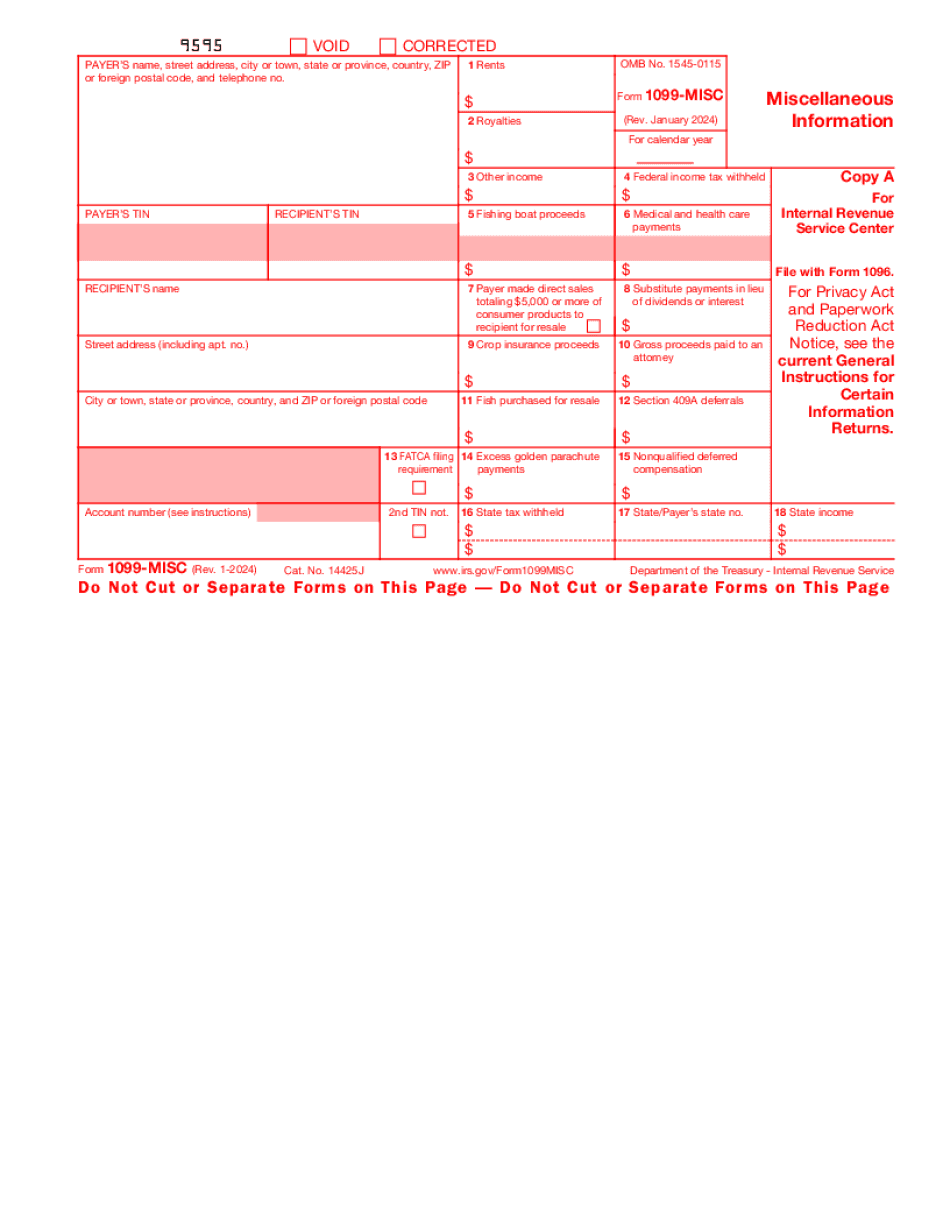

W2 is the form you get by Jan 31, which has all your pay and deductions on it. Taxes that were withheld from you paycheck like FED, STATE, SDI, Med, Social Security, etc. and the 1099 is for people that are independent that have there own business and pay all the taxes there self. You only get one of these if you are not an employee, and employee is someone whom has to be at a place at an certain time everyday, or someone that filed out a employment application, these are employees and should be getting a W2. You would of filed out a W4 with your employer, If you filed out an I-9 then your are self employed. But if they did not tell you that and you were under the impression that you were an employee you need to report them to the labor board or you will have to pay all those taxes yourself and that is about about 25% more. The employer would have to pay twice as much as you made, that is why they like to do 1099 aka under the table. You get ripped off when you do this. Big time. You dont want that. If they did that to you turn them in otherwise your screwed big time and it will always be the employers fault. Obviously